Learn Python and SQL with the Best Online Learning Platforms[dsm_icon_list_child text="Learn the most popular programming...

Why Payroll Services are Great for Organizations?

The digital jungle of today calls for automation in every process around us. Payroll services are third party providers that take over payroll functions on your behalf. Working with a payroll service provider allows companies to outsource payroll processing.

Full service: As the term “full service” implies, these payroll service providers do all the work for you. You simply provide basic business and employee information, and they do the rest.

DIY: With a DIY payroll provider, you’re required to perform some of the administrative tasks and the provider conducts the additional tasks of your choosing.

The biggest difference between the two is the price. A full-service approach will cost more than a piecemeal, DIY approach.

At the heart of payroll services is the automation of payroll processing, which includes calculating employee wages, withholding taxes, and ensuring compliance with various labor laws.

When a company uses payroll services, they begin by inputting employee information into the system. This data includes details such as hours worked, pay rates, tax withholding preferences from a W4 form, and any additional deductions or benefits they opt into.

Once the employee data is entered, the payroll service automatically calculates gross pay, deductions, social security, Medicare, and any other relevant contributions.

An essential feature of payroll services is their ability to ensure that the correct amount of taxes is withheld from each paycheck and that these funds are deposited with the appropriate government agencies. This includes federal, state, and local taxes, as well as any required unemployment insurance contributions.

Payroll services also generate important reports and records for both employers and employees. These reports include pay stubs, tax forms such as W-2s or 1099s, and summaries of all payroll activities.

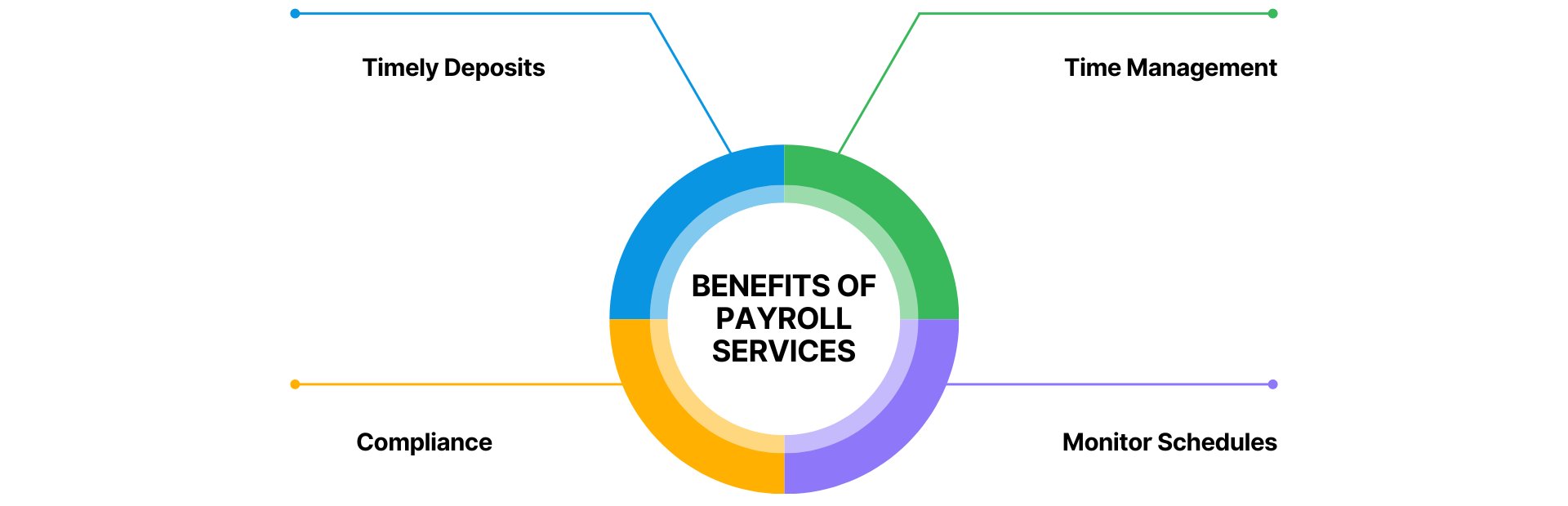

1. Timely Deposits: Outsourcing payroll mitigates errors and ensures that employees are paid on time, every time.

If you’re dealing with hourly and salary, full-time and part-time employees, payroll for independent contractors, and multiple schedules, rates, and pay periods, payroll can quickly become complicated and confusing.

2. Compliance: Payroll service providers will calculate and deduct employment tax from every paycheck. Not only does this take the time-consuming task of tax compliance off your hands, it also ensures that your employees aren’t confronted with any unexpected income tax bills at year end. Payroll services often handle tax compliance for you, but if you’re looking for more control over this aspect, consider using advanced payroll software that offers detailed tax filing features.

3. Time Management: Often within small businesses, the payroll function falls to the human resources team.

Once you outsource to a payroll service company, you can offload a variety of tasks, consolidate others into a central software application, and dramatically simplify the process of payroll overall. This way, more time can be spent on the tasks that pertain directly to your job description.

4. Monitor Schedules: The majority of payroll service companies offer self-service options that allow employees to directly input hours and submit paid time-off (PTO) requests.

In placing the responsibility for reporting in the hands of the employees, you eliminate bottlenecks and increase the accuracy of time management records. With scheduling data now in a central location, it’s easy for you to monitor hours and track attendance.

1. Sure Payroll

2. One Pay

Does not offer cross-platform app.

Limited payroll automations

3. Gusto

Transperant Pricing plans

Unlimited payroll plans

Domestik and international payroll contractors

Automatic tax filing services

Employees financial wellness tools

No free trials

Involves a lot of upfront manual data entry

Does not offer automated workflow

No international payroll services

Mobile app is available with limited access.

Next time, if you find payrolls messy, hectic, and require a lot of documentation, don’t indulge yourself in this complicated and complex work. Just hire an expert for this, and relax. You can save a lot of time and energy to do some other really important tasks and focus on improving your growth and finding new ideas to surpass your competitors.

We have already shared a list of the best payroll service providers with you. For more information and details on the top 10 payroll providers in 2024, you can check our editors’ best picks.

Frequently Asked Questions

Payroll services are outsourced services provided by third-party companies to handle all aspects of payroll processing. This includes calculating wages, withholding taxes, issuing payments, and maintaining compliance with government regulations.

Outsourcing payroll services can save time, reduce costs, minimize compliance risks, and free up internal resources to focus on core business activities. It also ensures accuracy and timeliness in payroll processing.

Payroll service providers stay updated with the latest tax laws and regulations. They handle tax filings, withholdings, and payments on behalf of the organization, ensuring compliance with federal, state, and local tax requirements.

Payroll service providers typically need employee information (e.g., names, addresses, social security numbers), pay rates, hours worked, benefits details, tax information, and direct deposit details.

Payroll services manage various employee benefits such as health insurance, retirement plans, and other deductions. They ensure that these deductions are accurately calculated and applied each pay period.

Costs can vary depending on the size of the organization, the complexity of the payroll, and the services provided. Common fee structures include per-employee fees, flat monthly rates, and additional charges for specific services like tax filing.

Payroll can be processed on various schedules, including weekly, bi-weekly, semi-monthly, or monthly. The frequency is typically determined by the organization’s preference and needs.

Yes, many payroll service providers offer integration with popular HR and accounting software. This allows for seamless data transfer and better management of employee information and financial records.

Reputable payroll service providers have protocols in place to quickly identify and correct errors. Organizations can usually contact customer support to resolve any issues, and some providers offer guarantees for accuracy and compliance.

Payroll service providers employ advanced security measures to protect sensitive employee data. This includes encryption, secure servers, and regular security audits to prevent unauthorized access and data breaches.

Editor’s Best Pick

Learn Python and SQL with the Best Online Learning Platforms[dsm_icon_list_child text="Learn the most popular programming...

Top 10 Platforms for Young Aspirants to Master Data Analysis Top 10 platforms clarify young professionals' upskilling needs. [dsm_card_carousel autoplay="off" equal_height="on" layout="inline" arrows="off" badge_background_color="#468f71" stretch_image="off"...

Showcase Your Data Expertise with Machine Learning Demonstrate your data expertise by mastering machine learning. Gain practical skills, solve real-world problems, and advance your career with cutting-edge techniques and industry insights. Industry grade courses at...

A Complete Guide For You in Web Development- Career, Skills, and Opportunities Exploring web development courses for professional opportunities Exciting business management opportunities at 50% offExperience affordable English language learning with great...

Explore the Art of Data Analytics for Successful Upskilling Explore platforms for data science courses, career options, and more. Real time SIM projects at affordable pricesExperience affordable English language learning with great discountsImprove your conversational...