The digital jungle of today calls for automation in every process around us. Payroll services are third party providers that take over payroll functions on your behalf. Working with a payroll service provider allows companies to outsource payroll processing.

Different Types of Payroll Services

Full service: As the term “full service” implies, these payroll service providers do all the work for you. You simply provide basic business and employee information, and they do the rest.

DIY: With a DIY payroll provider, you’re required to perform some of the administrative tasks and the provider conducts the additional tasks of your choosing.

The biggest difference between the two is the price. A full-service approach will cost more than a piecemeal, DIY approach.

How Do Payroll Services Work?

At the heart of payroll services is the automation of payroll processing, which includes calculating employee wages, withholding taxes, and ensuring compliance with various labor laws.

When a company uses payroll services, they begin by inputting employee information into the system. This data includes details such as hours worked, pay rates, tax withholding preferences from a W4 form, and any additional deductions or benefits they opt into.

Once the employee data is entered, the payroll service automatically calculates gross pay, deductions, social security, Medicare, and any other relevant contributions.

An essential feature of payroll services is their ability to ensure that the correct amount of taxes is withheld from each paycheck and that these funds are deposited with the appropriate government agencies. This includes federal, state, and local taxes, as well as any required unemployment insurance contributions.

Payroll services also generate important reports and records for both employers and employees. These reports include pay stubs, tax forms such as W-2s or 1099s, and summaries of all payroll activities.

Explore More →

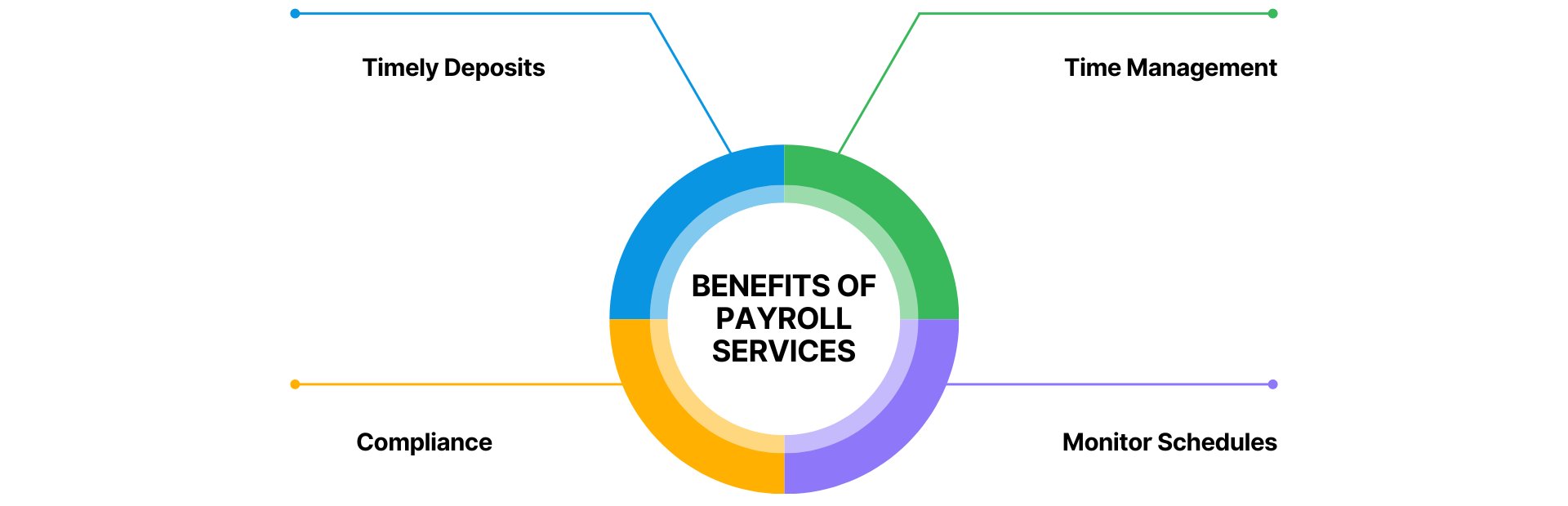

Benefits of Payroll Services